As the holiday season approaches, many people look for ways to add meaning to their traditional gift giving. Charity gifts are an increasingly popular option, allowing you to make a difference in the lives of those in need while giving something thoughtful to your loved ones.

Whether it’s …

- A charity Christmas gift

- Gifts that give back

- Charity donation presents

… your choice can help make your gift more than just another package under a Christmas tree.

Whether given through cash, a credit card, or even stock, charity gifts reflect the true spirit of the season: generosity, kindness, and support for those in need.

In this guide*, we’ll cover some of the best charity gifts, outlining …

- The importance of charitable giving

- Creative ideas for donation gifts for Christmas

- How to navigate tax benefits like the charity gifts tax deduction

The Importance of Charitable Giving

Charities play a vital role in addressing a variety of societal issues, from poverty to health care to education.

When you donate to a public charity or participate in gifts for a cause, your contribution can significantly impact people’s lives and even entire communities.

In fact, charitable giving strengthens society by empowering nonprofits to work toward solutions that benefit the public.

Furthermore, giving to charity as a gift provides a sense of fulfillment, knowing that you are helping others in need.

For example, Convoy of Hope, a nonprofit organization combating poverty and hunger around the world, offers potential donors very creative ways to help communities through its holiday gift catalog.

Your gift selection can:

During the holidays, incorporating charity Christmas gifts into your traditions amplifies the season’s meaning.

Whether you’re purchasing gifts with a purpose or products where proceeds go to charity, your choice will spread joy both to the recipient and to those who benefit from your donation.

Creative Ideas for Donation Gifts for Christmas

When it comes to holiday gifting, charitable Christmas gift ideas are perfect for those who want to share the joy of giving while supporting a good cause. Whether you’re looking for charity presents for friends, family, or colleagues, there are plenty of options to consider.

There are many creative ways to find Christmas gifts that give back. You might purchase handmade jewelry from artisans in developing countries or donate to a local food bank on someone’s behalf. For holiday gifts that give back, consider these four creative options.

1. Donation Gifts for Christmas

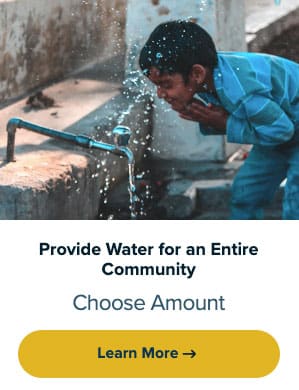

Organizations like Convoy of Hope and UNICEF offer charity gift catalogs that allow you to donate items like livestock, clean water, or educational supplies in someone’s name.

By giving a donation as a gift, you provide tangible benefits to communities in need and create a unique and meaningful present for the loved one you name as the sponsor.

2. Gifts That Support a Cause

Many businesses now offer gifts that give back — products where a portion of the proceeds is donated to charity.

Brands like Gifts for Good and Hope Supply Co. are known for their gifts with a purpose, with every purchase helping fund critical programs worldwide.

3. Charity Presents for Kids

Teach children the value of giving by purchasing charity gifts as presents for them.

Many organizations offer child-friendly donations like educational kits or school supplies that benefit children in underserved communities.

4. Charitable Christmas Gifts

Consider incorporating charitable Xmas gifts into your family’s holiday traditions by making donations on behalf of each family member.

This fosters a spirit of generosity and teaches important lessons about compassion and empathy.

Navigating Tax Benefits Like the Charity Gifts Tax Deduction

One of the often-overlooked advantages of donation gifts is the potential for significant tax benefits.

Donations to qualifying charities may be eligible for a charitable tax deduction.

The Convoy of Hope Foundation

This Foundation offers a variety of giving opportunities to maximize your giving and reflect your charitable goals and personal values.

The Foundation team can offer targeted giving strategies and answer a host of questions. An email to hopesociety@convoyofhope.org gets that process started.

Here’s a breakdown of how some key tax deductions work.

1. Income Tax Deduction

If you itemize your deductions on your Form 1040, you can claim a charitable contribution deduction.

This can reduce your taxable income, lowering your overall tax bill.

However, it’s important to keep receipts and acknowledgment letters from the charities you support to substantiate your contributions when filing taxes.

Contributions are usually limited to a percentage of your adjusted gross income (AGI), with most donations being deductible up to 60% of AGI.

However, there are specific limits for contributions of appreciated assets or donations to private foundations, which may be capped at 30% of AGI.

2. Donor-Advised Fund (DAF)

This giving vehicle allows individuals to make charitable donations and receive an immediate tax deduction while deciding over time which charities to support.

Under current tax law, contributions to a DAF are eligible for a deduction in the tax year in which the donation is made, even if the funds are distributed to the charities later.

This flexibility makes DAFs a popular choice for donors looking to maximize their deduction (and in some cases may allow them to itemize instead of taking the standard deduction).

Since DAF contributions are irrevocable and the funds can grow tax-free, they provide a strategic way to manage charitable giving while optimizing tax benefits.

3. Gift to Charity From IRA

If you are aged 70½ or older, you can make a qualified charitable distribution (QCD) of up to $100,000 directly from your traditional IRA to charity.

This allows you to satisfy your required minimum distribution (RMD) while also avoiding the inclusion of the distribution in your taxable income. By giving directly from your IRA, you not only reduce your taxable income but also ensure that the money is put to good use by a charity.

This method is particularly advantageous for those who don’t need the income from their RMD and want to support a cause.

4. Tax Returns and Charitable Contributions

When preparing your taxes, it’s essential to ensure that your donations are properly documented.

Contributions of more than $250 require written confirmation from the charity.

Be sure to include all of this when filing your tax returns to claim the correct deductions.

How To Give Charity Gifts Through an IRA

As mentioned above, donating from an IRA provides an excellent opportunity for those over 70½ to support charitable causes while meeting tax obligations.

A qualified charitable distribution (QCD) from a traditional IRA allows you to transfer funds directly to a charity, bypassing tax on the distribution.

This can count toward your required minimum distribution for the year without being taxed as income, making it an effective way to make donation gifts and lower your taxable income.

To give a gift to charity from an IRA, follow these steps:

- Confirm Eligibility: Make sure you are at least 70½ years old and that your donation qualifies as a QCD under the IRS guidelines.

- Choose a Public Charity: Ensure that the recipient organization qualifies as a 501(c)(3) public charity to maximize your tax benefits.

- Contact Your IRA Administrator: Request a direct transfer from your IRA to the charity. Be sure to inform them that this is a charitable contribution.

By choosing to give through your IRA, you can make a lasting impact on the charities you support while gaining significant tax advantages.

Next Steps

When it comes to holiday gifting, charity gifts and charitable Christmas gifts offer a way to spread joy and give back at the same time.

Whether you’re using your IRA to make a gift to charity, buying gifts with a purpose, or choosing donation gifts for Christmas, your thoughtful gesture can create a lasting impact.

Plus, with tax benefits like the charity gifts tax deduction and options for giving through a qualified charitable distribution, there’s no better time to give back than during the holidays.

*Disclaimer: Convoy of Hope and Convoy of Hope Foundation do not provide legal, tax, investment, or financial advice. The information in this document is intended for educational purposes only and should not be construed as professional advice. Donors are encouraged to consult with their own legal, tax, investment, or financial advisors when evaluating gifts to charity. Convoy of Hope and Convoy of Hope Foundation disclaim any liability arising from reliance on information provided herein.